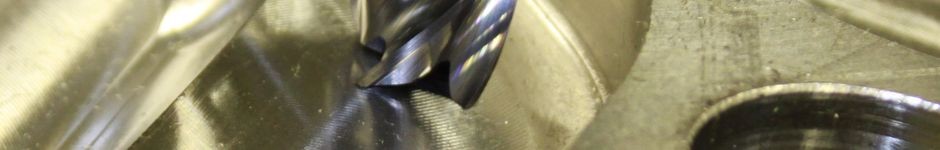

For example, if the availability of raw materials needed for production is very limited, this is a constraint that limits the business’s production output. The benefits for your company will depend on its size and industry and individual managers’ practices and preferences. In this example, the only tasks that would be assigned to the management accountant are budgeting and taxes. Given the time length involved in many plans, the organization also needs to factor in the potential effects of changes in their senior executive leadership and the composition of the board of directors. This short video goes inside a manufacturing process to show you how machines, people, planning, implementation, efficiency, and costs interact to arrive at a finished product. Accounts receivable (AR) is the money owed to a company for a product or service bought on credit.

What Is the Main Focus of Managerial Accounting?

Obviously, to be successful, either of these businesses must determine the goals necessary to meet their particular strategy. This information helps organizations better understand how well they adhere to set budgets and make changes if needed. Another aspect of this methodology is examining an organization’s needs, choosing the correct purchase type, and finding the best way to finance that purchase. For managerial accounting, weekly and monthly budgets govern the types of products sold, product inventory levels, and the price points needed to ensure that businesses maintain sufficient margins to cover costs and remain solvent.

Constraint analysis

An accounting period is usually set to be http://honda-fit.ru/forums/index.php?showtopic=22850 year-long and this could either be a regular calendar year or a fiscal year starting from a particular day. Financial accounting statements are usually run and presented at the end of this period. Managerial accounting is intended for internal administrators of a business to make internal decisions.

Accounting managers

- Analyses are often focused on targeted segments of a business rather than on a company as a whole.

- The job titles often differ in salary and responsibilities, though you’ll find some common tasks and skills in most jobs in managerial accounting.

- Product costing is the process of determining the total cost involved in the production of goods and services.

- Managerial Accounting students can be discouraged by the tendency of their textbook to be overly laden with jargon and numeric calculations.

Companies optimize cash flow so that they do not worry about future events and insufficient http://biologylib.ru/books/item/f00/s00/z0000009/st003.shtml finances to complete them. Overhead charges are determined for each product by dividing the whole expense by the number of goods or other factors like storage space. External parties need to be protected from the incompetence of a firm as they are the main users of financial accounting information. Because of this, financial accounting procedures are required to fulfill certain standards set by regulatory bodies. Financial accounting activities are regulated by external standards as opposed to the more flexible requirements placed on managerial accounting procedures. The main difference between managerial accounting and financial accounting is the users of the information generated.

- Data from managerial accounting empower decision-making at both an operational and strategic level.

- Management accountants generate the reports and information needed to assess the results of the various evaluations, and they help interpret the results.

- Business managers can then make the appropriate decisions to eliminate the constraint.

- A performance report provides information about the outcome of an activity or the work of an individual.

- Managerial accounting is targeted more toward a company’s managers and employees.

There were some subject areas that I felt could have been expanded, particularly with more introductory/context-building information, but overall, everything is included. Objectives are included in the text at the beginning of a section, but they are all numbered “1” and are not summarized anywhere. Good examples of how concepts are actually used, and the impact on financial statements. A budget is generated by a business to create a financial framework according to which business goals can be achieved without overspending. It is usually based on past experiences and contains all the planned earnings and expenditures expected by a business within a period.

People (professionals) referenced in the examples were gender neutral with a representative balance. It would help if http://russkialbum.ru/tags/Build/page/7/ the answers to problems or exercises were on a different page or indexed in the back of the book. I greatly appreciate the effort of the authors in completing this book and making it available to students at no charge.

Tasks and services provided

In addition, inclusion of an index/glossary would have been really helpful for quick search. Cost managerial accounting reports help businesses to compare the total cost of producing goods or services with the selling price for each unit. It contains all the costs for raw materials, overheads, and labor, among other additional costs in running a business.

What Is Management Accounting?

Companies that also wish to get loans, entice investors, or fulfill debt covenants set by financial institutions also conform with the GAAP. Use our Excel internal rate of return calculator to determine an investment’s internal rate of return. Capital Budgeting refers to the process of evaluating potential investments and projects, such as real estate, new equipment, or repairs to determine whether they are worth pursuing. Accountants use a variety of calculations to assess the value and return on investment the proposed capital investment offers. Constraint analysis is concerned with identifying limiting factors in a system and working to eliminate them. These constraints, also called bottlenecks, can be internal or external factors that limit the business’s profitability.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions. Revaluation is an accounting technique that involves the review of the recorded book value of an asset in relation to its true market value. Revaluation accounting is only used where the fair value of an asset can be reliably measured.