As there must be something to it, let’s examine each principle closely — and then get into the 3 foundational pillars of construction accounting. On the construction side of things, the individuals doing this type of work include construction bookkeepers or construction accountants — or, more generally, bookkeeping professionals. In contrast, construction companies face a different and much more complicated series of challenges. Construction accounting deals with long-term, flexible contracts with a ton of irregularities — in comparison to other sectors, like retail.

Reasons to Hire a Bookkeeper for Your Small Business

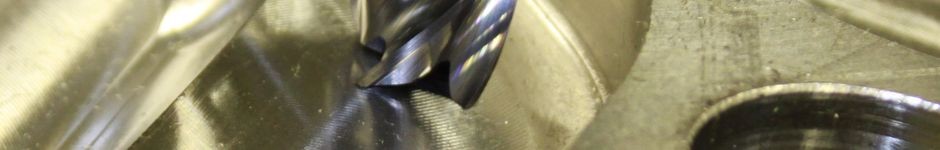

There are many software options available that are specifically designed for construction companies, such as QuickBooks for Contractors, Foundation Software, and Sage 100 Contractor. Construction payroll is more complex than in many other industries, as it involves tracking multiple workers, contractors, and varying pay rates. Additionally, compliance with labor laws and union agreements adds another layer of difficulty. Job costing tracks expenses on a per-project basis, offering a granular view of where costs are incurred. This approach is essential in construction, where each project has unique budgets, timelines, and resource requirements. Automated systems streamline invoice collection, approval workflows, and expense tracking, allowing bookkeepers to process financial data more efficiently.

Government Contracts

- Examples of assets include cash, accounts receivable (AR), inventory, and due from construction loans.

- While there are many places where you can find a certified accountant, your best option is to browse the American Institute of Certified Public Accountants database.

- Ideal debt-to-equity for most companies is between 1 and 2, and companies with a debt-to-equity ratio higher than 2 may be unable to pay off its debts.

- Projects like government-funded projects require you to pay a prevailing wage, a minimum hourly rate that’s typically higher and determined by each state’s Department of Labor.

- According to the Construction Financial Management Association, pre-tax net profits average between just 1.4% and 3.5% for contractors and subcontractors.

- To calculate the current ratio, simply divide current assets by current liabilities.

The act of withholding payment is called contract retainage and is part of a contract signed by the contractor and customer before the project’s implementation. At any rate, the accounts receivable aging report grants this helpful overview to the construction business. This means that the worker’s state of residence can issue credit for taxes paid on income that’s earned in a different state. Most beneficially, if they implement this billing method, construction companies can bid for large, multi-year projects.

Tip 2: Use job costing to manage project costs and general business ledgers

A prevailing wage is the standard hourly rate for a worker in a particular state or locality determined by regulatory agencies and each state’s State Department of Labor. Automatically https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects maintain a full audit trail within Access Coins for transactional and non-transactional data to ensure compliance with internal and external audits. Not everyone is cut out to be a bookkeeper or financial expert but software makes doing these things much easier today. Even better is to back up your records onto a cloud service, so they’re accessible from anywhere.

During an ongoing project, the amount subcontractors demand can change, resulting in changes to actual costs. Also known by the name cash flow statement, this type of report shows the amount of cash (or cash equivalents) that enter and leave a company. Apart from these, the accounts payable aging report should consist of the vendor’s name and payment terms. Similarly, construction companies have to be careful not to overpay unemployment tax.

You should also ensure it’s compatible with the size How to leverage construction bookkeeping to streamline financial control and type of company you have. Develop an easy-to-follow system and create a habit of recording each transaction at the end of each workday. Bridgit Bench is a workforce planning platform built to help construction professionals, including accountants. Common scenarios for change orders include the owner requesting adjustments like moving a wall, adding a window, or changing the flooring material. These are called ‘additive change orders’ and typically increase the contract price.

Construction payroll deals with complexities that other industries don’t normally have to worry about, like prevailing wage, union payroll, and multi-state-multi-city payroll requirements. This can lead to different timing of revenue recognition compared to the traditional method. Larger businesses and those who maintain inventory must use an accrual basis of accounting to comply with U.S GAAP (Generally Accepted Accounting Principles).

When done properly, job costing helps construction managers and accountants predict costs and assess project budgets more precisely. Speaking of which, job costing concerns itself with 2 types of costs — direct and indirect costs. For starters, construction accounting tracks multiple projects, accounts, and localities, as opposed to regular accounting — which typically focuses on sectors like retail or manufacturing.