This course is completely online, so there’s no need to show up to a classroom in person. You can access your lectures, readings and assignments anytime and anywhere via the web or your mobile device. As a beginner-level course, no skills or experience is required. When you complete this course, you’ll gain a foundational understanding of accounting principles and an introduction to QuickBooks Online. Earning a bookkeeping certificate can be a valuable investment in your bookkeeping or accounting career.

CPE credits

CFI courses offer practical skills, templates, and tools to enhance your accounting knowledge. Beginning your first subscription to Coursera starts a seven-day free trial. On the eighth day, your free trial automatically becomes a paid subscription. Coursera Plus subscriptions, which come with a host of included classes, are priced reasonably as long as you’re actively taking a course.

QuickBooks offers training events and webinars that cater specifically to small business owners. Online business courses offer a comprehensive approach and will cover topics like strategy, development, social media marketing, time management, and digital marketing. The advantage of these courses is in their flexibility, as they allow business owners to acquire knowledge at their own pace and convenience through online learning. Such notice is not intended nor will it have the effect of relieving the Participant of any liability under this Agreement or applicable law. Additionally, online courses often include interactive materials and exercises to help reinforce your learning. Some popular online bookkeeping courses also offer certification upon completion, which can be a valuable asset when searching for a job or promoting your services as a bookkeeper.

24/7 support resources are available for Premium levels that include scheduled callback and digital self-help resources. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to limit each telephone contact to one hour and to one incident.

Have questions about payments, refunds, financial aid, or general troubleshooting?

- But you’ll keep your self-paced classes FOREVER (including all future updates).

- “Enjoyed the class and plan to take the Advanced Quickbook class within the month.”

- Our training sessions can be tailored specifically to your needs, available as public and private sessions, and with instruction delivered in-person or online.

- To stay ahead of the competition, you need to continuously develop and hone the essential skills that will help you run your business successfully.

- Explore the best practices for property management companies that use QuickBooks.

You’ll receive hands-on exercises so you can get real experience using QuickBooks. Then, check your knowledge with our interactive sample tests to practice for the exam. Learn to set up payroll from scratch, track time, pay employees, and solve common and advanced transactions to make the most out of Payroll.

- This certificate prepares you to become a bookkeeper for public accounting, private industry, government, and nonprofit organizations.

- If you cancel your membership after 30 days, you’ll lose access to QuickBooks Live Help.

- Many of our live QuickBooks courses have hands-on exercises so you can work along with the instructor.

- We provide QuickBooks bookkeeping certification, and we help you ace the exam with QuickBooks bookkeeping certification prep courses.

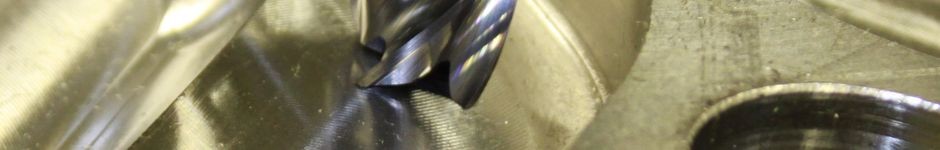

- Our training rooms are outfitted with the equipment needed for training and provide an interruption-free space so you can concentrate fully on learning.

Join over 3,400 global companies that choose Coursera for Business

It’s a whole new level of training and expertise that sets you up to thrive—year after year. All of our QuickBooks training is available at our locations listed below. Click the plus intuit quickbooks training classes sign on the right to expand and show the sites grouped by state. This certification track is for QuickBooks Online version (cloud-based).

Get noticed with achievement badges

For beginners, most people can gain a solid understanding of the basics within a few weeks. Whether you need a quick refresher or a deep dive into all QuickBooks features, our flexible training schedule accommodates your learning pace. Yes, with ONLC’s training options you can attend our live, online classes that are fully interactive, or opt for our On-Demand QuickBooks training that is self-paced, self-study. You get to choose the learning format that’s best for you and your schedule.

Organize your business data, learn everyday money in and money out transactions, understand quotes, deposits, and sales orders, learn accounting tasks and procedures, and save time along the way. The Small Business Accounting 101 course equips small business owners with the ability to comprehend financial reports. Participants will delve into the intricacies of accounting terms, and understanding financial statements such as balance sheets, income statements and cash flow statements. This knowledge forms the foundation for evaluating a business’s financial health, identifying areas of strength and addressing potential challenges. This 1.5-hour course will cover all the essential steps and considerations to help you migrate your clients’ QuickBooks Desktop company files to QuickBooks Online.

This training is fully interactive with an online instructor. You will do hands-on exercises and labs throughout the class with the instructor’s support and can ask questions at anytime. Attend this live Quickbooks training class from your own location or any of ONLC’s centers for an interruption-free learning environment.

How much does this certificate cost?

Our courses are designed for all levels of expertise, from beginners to advanced users. Our experienced instructors will guide you through the fundamentals and help you build a strong foundation in using QuickBooks effectively. Get a free priority listing on our Find-a-ProAdvisor online directory, showcasing your skills and services to a vast range of potential new clients. Explore best practices for schools and daycares that use QuickBooks. Learn how to set up your company file in three different ways, keep track of who pays you, record transactions, and examine reports.

Whether you’re new or advanced, cloud or desktop, we’ll help you develop skills your clients can depend on. As a QuickBooks Certified ProAdvisor, you’ll earn points and rewards that can help to grow your firm and support your clients. ONLC’s Group Training solutions offer an efficient and cost-effective way to upskill staff in QuickBooks. Our training sessions can be tailored specifically to your needs, available as public and private sessions, and with instruction delivered in-person or online. Gain the expertise needed to advance your career, as jobs in QuickBooks demand a solid understanding of this powerful accounting software.

Excel and Word training designed just for QuickBooks Users. Use this class to build on what you learned in QuickBooks Foundations. Master more difficult (but common) features, become an expert on reports, and learn even more workarounds, tips, and tricks to make the most out of QuickBooks. You can view any QuickBooks course or QuickBooks class on any device with an internet connection.

Along the way, you’ll learn time-saving techniques, make the most out of your reports, and even learn more advanced topics like sales tax, payroll, and inventory. Refunds and certification examsIf you refund your purchase, you can no longer sign up for more of the included certification exams. If you’ve already registered for an exam or taken an exam before you request a refund, we will deduct the cost of the exam from your refund. To develop successful business strategies, it’s essential to have a solid foundation of knowledge and skills.

Learn best practices in QuickBooks for businesses in the retail and restaurant industries. Set up accounts and items, record daily sales, enter bank deposits, send purchase orders and receive inventory, run reports to calculate your profitability, and review sales and statements. Learn how to set up and record retainers, process settlement payments, and the transactions for Trust/IOLTA accounts. Many of our live QuickBooks courses have hands-on exercises so you can work along with the instructor. Most of the time, your instructor shares their screen and uses QuickBooks to guide you through everything you need to use QuickBooks effectively. Setting up a strong foundation for a business’s financial books is crucial for long-term success.