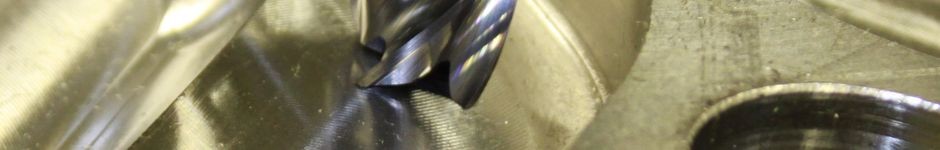

Keeping your fleet well-maintained is also essential, and this includes getting regular oil changes and other standard maintenance on time. The best way to save on gas prices is to download an app like GasBuddy, which will help you identify the best-priced gas in your vicinity. If you’re just starting your business, you’ll have to factor in the costs of the trucks themselves and the insurance to cover them. You’ll also likely need a general business license, sales tax license, and possibly a license to conduct business across state lines. Or use connector apps like Zapier to integrate hundreds of other apps and add information like your IFTA fuel tax reporting. Because the IRS sees semi-trucks as qualified nonpersonal use vehicles, you must deduct your actual auto costs instead of using the standard mileage method.

Online and Digital Services

However, the establishment of an accounting division, hiring and training bookkeeping personnel and buying accounting software is costly. Such companies, whose core competency is not accounting and bookkeeping, can benefit by outsourcing to professional accounting firm. FreshBooks also makes tracking expenses and preparing for tax time ridiculously easy. Connect your bank account and credit card and watch as your expenses are automatically imported and categorized. Keep on budget and know exactly how much you’re spending with easy-to-understand reports. Cut down on tedious administrative tasks by automating payment reminders, setting up a billing schedule and connecting your business bank account and credit card to automatically import expenses like fuel.

Access to a highly trained certified accountant

Accounting is more sophisticated and analytical than bookkeeping, and there’s often more at stake. For example, accounting errors could cause you to miss out on valuable financing or get you in trouble with the Internal Revenue Service (IRS). Accounting is one of the least exciting aspects of small business ownership for many owner-operators.

Invoicing Software and Time and Expense Tracking for Truckers

Don’t miss a single expense by adding one of 70 popular apps that integrate with FreshBooks. Add payroll expenses thanks to Gusto, accept online payments with Stripe and PayPal and track mileage with Everlance. When compiling this list, we focused on what 5 different services would be most important to truckers when managing their books. From P&L statements to emergency bookkeeping services, one of these truck bookkeeping services will perfectly fit your needs. One of the most common mistakes small business owners make is putting their accounting responsibilities on the backburner for too long.

All business owners must make quarterly estimated tax payments to cover their income and self-employment taxes, and truck drivers are no exception. You’ll incur penalties and interest if you don’t meet your federal and state liabilities. Join over 1 million businesses scanning receipts, installment sales accounting method creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

The IFTA is a way to redistribute the fuel taxes truck drivers pay in the lower 48 states and the 10 Canadian provinces. It ensures your funds go to the areas where you used your fuel instead of the ones where you purchased it. No matter your fleet size or how long you have been in business, it is crucial to understand basic accounting terms and financial documents. Accounting explains your company’s financial history, health and overall performance.

- Such companies, whose core competency is not accounting and bookkeeping, can benefit by outsourcing to professional accounting firm.

- Accounting explains your company’s financial history, health and overall performance.

- Shoeboxed’s scanner and organizer web app takes your physical documents, digitizes them, and saves them to the cloud, so they’re accessible anytime, anywhere.

- Without them, you run the risk of losing hundreds, even thousands, in taxes.

Another decision every small business owner has to make is what type of legal entity they want to use. Sole proprietors are the default structure, so owner-operators who start doing business without filing any paperwork will fall into that category. For any bills that don’t have an option to go digital, you can use Shoeboxed to scan your paper copies and save them to the cloud. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

This will free up your cash flow and let you scale as your business attracts new customers. Discover how easy it is to do your bookkeeping with software that’s designed for the trucking industry, not accountants. FreshBooks frees you from the hassle of paperwork with powerful features like professional invoicing with user-friendly customization options. Set automatic payment reminders, get notified when customers open invoices, accept payments online and more. The all-new Accounting Software from FreshBooks helps you take control of your trucking business accounting with ease, without the stress. That’s another reason paying for tax services is essential for the transportation business.